Sushi in Cache County... There are several sushi restaurants in Logan, and we've tried three of them. Two of them we'd rate as “ok”, but a long way from the glory of Hana Sushi in El Cajon (our favorite sushi spot before we moved up here).

But now we've discovered another source of sushi here – one that's just as good as any sushi restaurant we've tried here, but for less than half the price. It's a most unlikely place to find sushi: a grocery store. Macey's in Millville, to be specific. You can gorge yourself on decent sushi purchased there for under $20, which is remarkably inexpensive as sushi goes. And you can eat it at home, surrounded by peace and quiet.

I suspect we'll be visiting Macey's for sushi quite often :)

Tuesday, February 3, 2015

The end days are nigh, part 40,273...

Homo sapiens is doomed...

My kind of groundhog...

You go, groundhog!

Can we ship Jimmy to Washington, D.C.?

Radio Shack is going down...

Radio Shack is going down... For the last time, it appears. It's hard to imagine how any physical store could compete with the likes of Amazon, DigiKey, Mouser, or the other 10M or so online stores...

Where do software developers dream of working?

Where do software developers dream of working? The best developers I've known over my career want to work either for themselves (that is, their own start-up company), for other start-ups, or for companies doing big, impressive, exciting things (Google, Apple, etc.).

What's not on that list? The federal government.

It's really, really hard for me to imagine that the U.S. Digital Service is going to attract a significant number of good engineers.

It's really, really easy for me to imagine that it's going to attract hordes of incompetent, entitled engineers for whom Wally (of the Dilbert strip) is the model. Just contemplating the inevitable office buildings full of mandatory bureaucratic managers is enough to make me feel nauseous.

You know how the U.S. Post Office compares to, say, UPS, in customer service, responsiveness, reliability, and innovation? Yeah, that will be how the U.S. Digital Service compares with, say, Apple...

What's not on that list? The federal government.

It's really, really hard for me to imagine that the U.S. Digital Service is going to attract a significant number of good engineers.

It's really, really easy for me to imagine that it's going to attract hordes of incompetent, entitled engineers for whom Wally (of the Dilbert strip) is the model. Just contemplating the inevitable office buildings full of mandatory bureaucratic managers is enough to make me feel nauseous.

You know how the U.S. Post Office compares to, say, UPS, in customer service, responsiveness, reliability, and innovation? Yeah, that will be how the U.S. Digital Service compares with, say, Apple...

It happens every time...

It happens every time... It seems like every few years, some technology pundits will start squeaking about how electronic technology has hit a wall: there's no way that devices can get any smaller or any faster. Every time they have reasons that sound plausible – this or that barrier is preventing any progress. And each and every time, some clever scientist, engineer, or (increasingly) team comes up with yet another breakthrough that completely demolishes the previously impossible-to-overcome barrier.

This just might be the next such breakthrough...

This just might be the next such breakthrough...

This is gonna leave a mark...

This is gonna leave a mark ... but I'm not sure exactly what this mark is gonna look like...

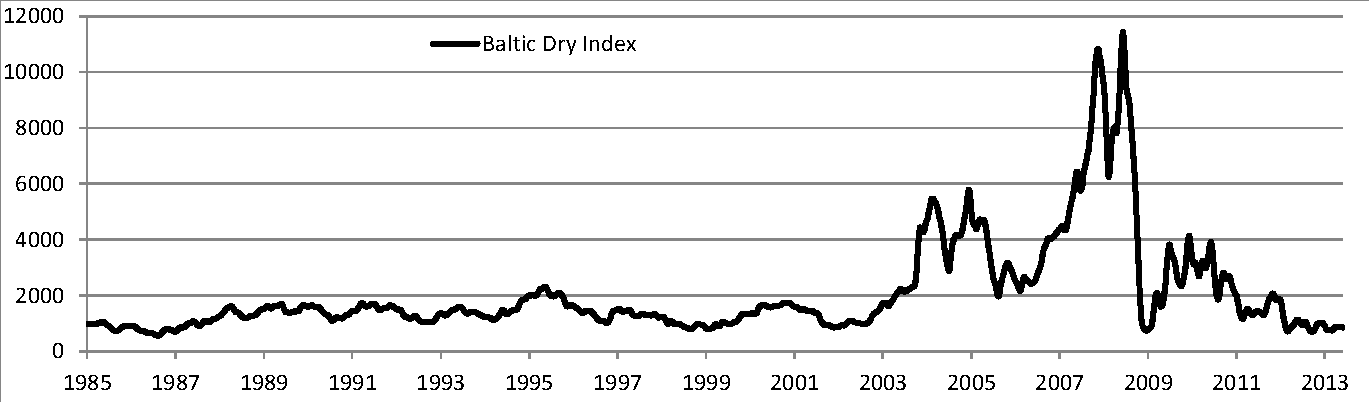

The graph at right is for the Baltic Dry Index, a rough gauge for the price of shipping stuff by sea. In our globalized economy, an amazingly high fraction of the ordinary things we all buy are shipped by sea (or their components are), so the cost of shipping has more of an impact than you might immediately think.

What drives this cost is complicated (see the linked Wikipedia article above) and interesting. There is of course the usual economic force of supply (shipping capacity) versus demand (goods to be shipped). Added to that, though, are the interesting variables of the high capital costs of ships, the typically high leverage of shipping companies (with some notable and large exceptions), and the long lag time to build new ships (generally 2 to 3 years. There's also another phenomenon: every time shipping capacity exceeds demand, there are idle ships – very expensive – and somehow the accident rate always goes up during these periods. Lots of ships are lost to storms, explosions and fires at sea, and never-explained circumstances.

Well, the bottom is falling out of the Baltic Dry Index. There's a lively discussion at Zero Hedge. What does it all mean? Partly it's over-capacity: ships ordered during the boom times of a few years ago are coming on line, and their added capacity exceeds even a growing demand. However, shipping demand plummeted during the recent recession, and still has a long way to go before it has recovered to pre-recession levels – thus making the over-supply situation even worse. With the price of shipping plummeting, the more leveraged and less profitable shippers are going to start failing (there will be bankruptcies and pennies-on-the-dollar buyouts), and there will probably be a jump in accidents at sea as ship owners see insurance payouts as a better route than non-profitable shipping runs. We'll also probably see price reductions – small for most things, but larger for those goods for which shipping costs are a significant fraction of their overall cost (think bulk goods like ores, coal, etc.). It might provide a boost for the stock market, too.

How long will it last? I haven't a clue. Are there bad outcomes possible? Oh, certainly. With enough failures in the shipping industry, capacity could fall dramatically – and as it approaches demand, shipping prices will crawl back up out of the cellar, unwinding all the positive effects of lower costs. In that respect, its a bit like oil prices – though the overall contribution of shipping costs to the economy is tiny by comparison to that of oil...

The graph at right is for the Baltic Dry Index, a rough gauge for the price of shipping stuff by sea. In our globalized economy, an amazingly high fraction of the ordinary things we all buy are shipped by sea (or their components are), so the cost of shipping has more of an impact than you might immediately think.

What drives this cost is complicated (see the linked Wikipedia article above) and interesting. There is of course the usual economic force of supply (shipping capacity) versus demand (goods to be shipped). Added to that, though, are the interesting variables of the high capital costs of ships, the typically high leverage of shipping companies (with some notable and large exceptions), and the long lag time to build new ships (generally 2 to 3 years. There's also another phenomenon: every time shipping capacity exceeds demand, there are idle ships – very expensive – and somehow the accident rate always goes up during these periods. Lots of ships are lost to storms, explosions and fires at sea, and never-explained circumstances.

Well, the bottom is falling out of the Baltic Dry Index. There's a lively discussion at Zero Hedge. What does it all mean? Partly it's over-capacity: ships ordered during the boom times of a few years ago are coming on line, and their added capacity exceeds even a growing demand. However, shipping demand plummeted during the recent recession, and still has a long way to go before it has recovered to pre-recession levels – thus making the over-supply situation even worse. With the price of shipping plummeting, the more leveraged and less profitable shippers are going to start failing (there will be bankruptcies and pennies-on-the-dollar buyouts), and there will probably be a jump in accidents at sea as ship owners see insurance payouts as a better route than non-profitable shipping runs. We'll also probably see price reductions – small for most things, but larger for those goods for which shipping costs are a significant fraction of their overall cost (think bulk goods like ores, coal, etc.). It might provide a boost for the stock market, too.

How long will it last? I haven't a clue. Are there bad outcomes possible? Oh, certainly. With enough failures in the shipping industry, capacity could fall dramatically – and as it approaches demand, shipping prices will crawl back up out of the cellar, unwinding all the positive effects of lower costs. In that respect, its a bit like oil prices – though the overall contribution of shipping costs to the economy is tiny by comparison to that of oil...

“We will come to regret this, bitterly.”

“We will come to regret this, bitterly.” That's a quote from the Patterico blog, talking about the (now presumed) FCC proposal to regulate the Internet in the U.S. Here's a slightly less succinct, but more pungent, assessment from Warren Meyer of CoyoteBlog:

Some members of the FCC have been rather publicly itching to get their bureaucratic mitts on the Internet for quite some time, and the money-motivated political types (that would be all but about three of them) have long been eying it as a source of untapped bribes campaign funding. What has stopped these leeches from following through with their desires is the utter lack of any excuse reason for doing so. What's different now? The notion of “net neutrality” has somehow caught on, giving them the perfect political cover for a power grab. Why the notion of net neutrality has caught on is a complete mystery to me – it's an entirely hypothetical problem, with zero current or historical examples. Competitive pressures seem very likely to keep it from ever being a problem. Nevertheless, the non-technical masses have somehow become terrified of net inequality, and the bleating can be heard far and wide. Me, I see the disgusting leers of toad-like bureaucrats as they reach for ever more power...

Here is my official notice -- you have been warned, time and again. There will be no allowing future statements of "I didn't mean that" or "I didn't expect that" or "that's not what I intended." There is no saying that you only wanted this one little change, that you didn't buy into all the other mess that is coming. You let the regulatory camel's nose in the tent and the entire camel is coming inside. I guarantee it.Mr. Meyer's post is titled “Sorry, But All You Internet Users Appear to Be Idiots” – rude, but definitely to the point.

Some members of the FCC have been rather publicly itching to get their bureaucratic mitts on the Internet for quite some time, and the money-motivated political types (that would be all but about three of them) have long been eying it as a source of untapped bribes campaign funding. What has stopped these leeches from following through with their desires is the utter lack of any excuse reason for doing so. What's different now? The notion of “net neutrality” has somehow caught on, giving them the perfect political cover for a power grab. Why the notion of net neutrality has caught on is a complete mystery to me – it's an entirely hypothetical problem, with zero current or historical examples. Competitive pressures seem very likely to keep it from ever being a problem. Nevertheless, the non-technical masses have somehow become terrified of net inequality, and the bleating can be heard far and wide. Me, I see the disgusting leers of toad-like bureaucrats as they reach for ever more power...