This is gonna leave a mark ... but I'm not sure exactly what this mark is gonna look like...

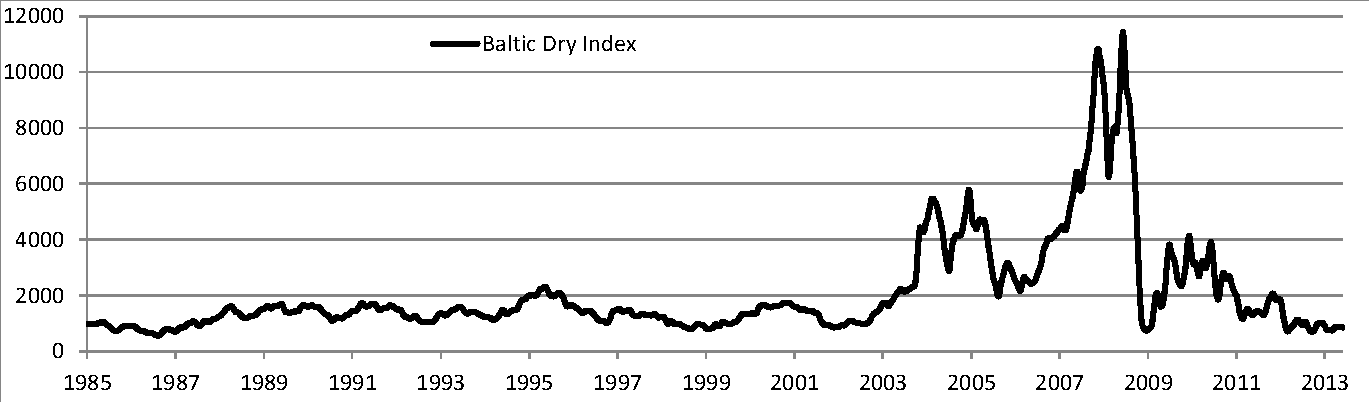

The graph at right is for the Baltic Dry Index, a rough gauge for the price of shipping stuff by sea. In our globalized economy, an amazingly high fraction of the ordinary things we all buy are shipped by sea (or their components are), so the cost of shipping has more of an impact than you might immediately think.

What drives this cost is complicated (see the linked Wikipedia article above) and interesting. There is of course the usual economic force of supply (shipping capacity) versus demand (goods to be shipped). Added to that, though, are the interesting variables of the high capital costs of ships, the typically high leverage of shipping companies (with some notable and large exceptions), and the long lag time to build new ships (generally 2 to 3 years. There's also another phenomenon: every time shipping capacity exceeds demand, there are idle ships – very expensive – and somehow the accident rate always goes up during these periods. Lots of ships are lost to storms, explosions and fires at sea, and never-explained circumstances.

Well, the bottom is falling out of the Baltic Dry Index. There's a lively discussion at Zero Hedge. What does it all mean? Partly it's over-capacity: ships ordered during the boom times of a few years ago are coming on line, and their added capacity exceeds even a growing demand. However, shipping demand plummeted during the recent recession, and still has a long way to go before it has recovered to pre-recession levels – thus making the over-supply situation even worse. With the price of shipping plummeting, the more leveraged and less profitable shippers are going to start failing (there will be bankruptcies and pennies-on-the-dollar buyouts), and there will probably be a jump in accidents at sea as ship owners see insurance payouts as a better route than non-profitable shipping runs. We'll also probably see price reductions – small for most things, but larger for those goods for which shipping costs are a significant fraction of their overall cost (think bulk goods like ores, coal, etc.). It might provide a boost for the stock market, too.

How long will it last? I haven't a clue. Are there bad outcomes possible? Oh, certainly. With enough failures in the shipping industry, capacity could fall dramatically – and as it approaches demand, shipping prices will crawl back up out of the cellar, unwinding all the positive effects of lower costs. In that respect, its a bit like oil prices – though the overall contribution of shipping costs to the economy is tiny by comparison to that of oil...

No comments:

Post a Comment